For too long brand and sensory insight have been kept apart. Often, companies are organised in such a way to keep these very teams apart, meaning key insights aren't being shared.

We know all aspects of the sensory experience impact how we shop and what we buy. It is why 83% of us agree that smells and fragrances can transport you somewhere else and 78% like to handle products so they can test them for freshness instore.

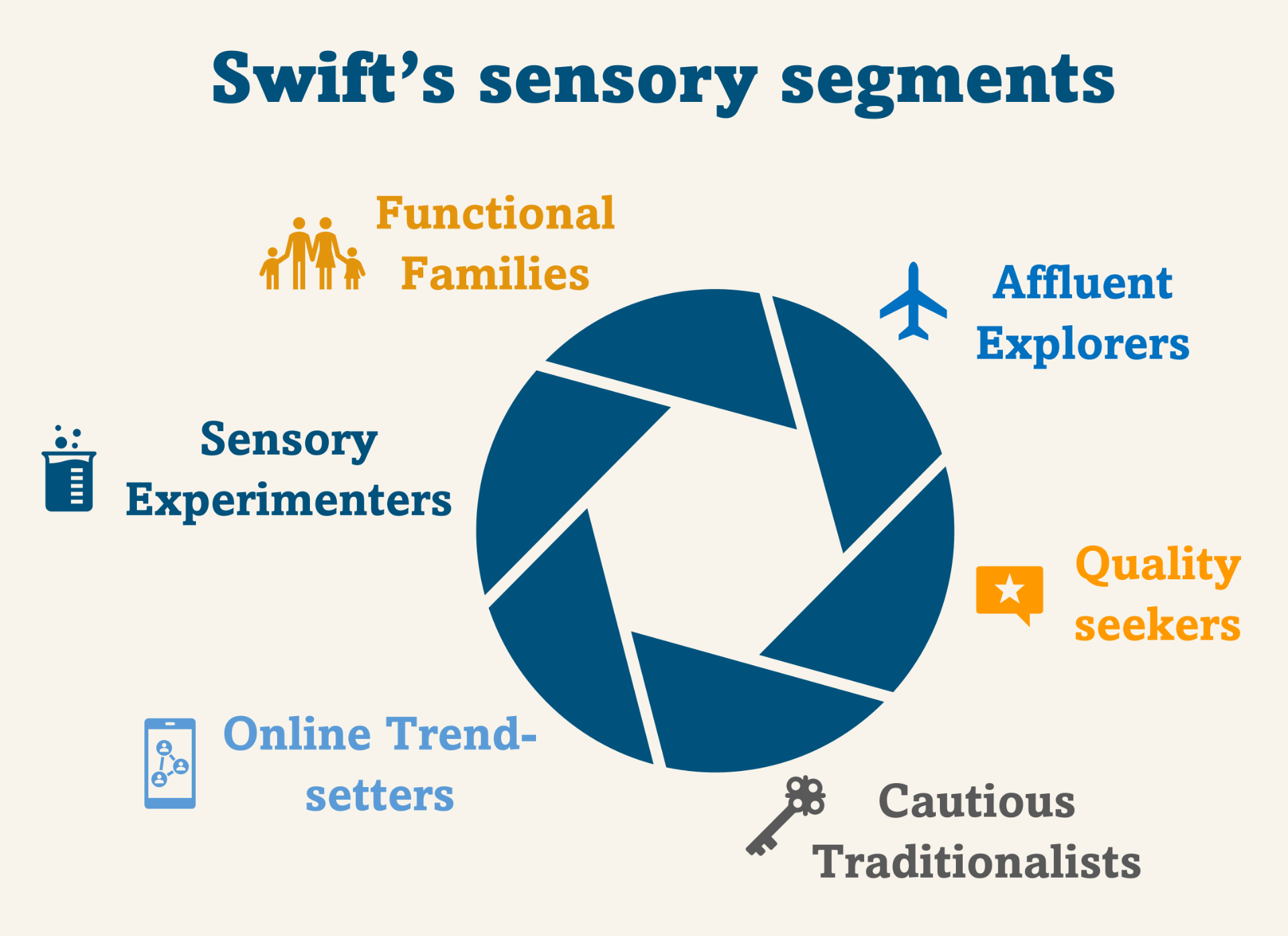

We're fortunate at Swift to have team members from both disciplines working together and it's prompted us to put our money where our mouth is and conduct our own research to bridge this gap. The first stage was "Swift's Sensory Segments".

Our 6 sensory groups are based on attitudes to shopping and their sensory preferences rather than behaviour alone. Our final segments were selected because they align with behaviour and demographics, but we could already easily explain why they buy what they buy. This ensures our segments are something you can tangibly target but can no doubt relate to both personally and from the people you speak to in a typical research project. For example, our "Functional Families" are probably the easiest to relate to group. Here's how they would describe themselves;

"I have a busy life, so I look for what I buy from supermarkets to be simple and functional. I tend to stick to the same brands and own label products but can be tempted by special offers or an interesting twist on something I would buy anyway"

Our Functional Families feature younger families with some budget restraints and contain our largest proportion of vegan and vegetarians. This group is shopping on a budget and there are examples, time and time again, of being disrupted at fixture by something colourful or a small twist on the ordinary. This group will pay a small premium for convenience formats and packaging that just works. Here's a couple of examples;

"I liked the packaging; they were good for packed lunches and easy for my children to open by themselves"

"The packaging was vibrant, and it was a different material to the usual tins that fish comes in. It exceeded my expectations; it was fresh and flavourful with no bones and the unused half could go straight in the fridge in the pot it came in"

As a pragmatic researcher, I find myself reminding clients time and time again that we shop on autopilot and often stick to what we know. We do have a group that embodies just this - our "Cautious Traditionalists" prefer to stick to the status quo, opting for simpler, gentler products. They prefer to shop in store and buy British when they can. However, our remaining 4 segments are much more open to trialling new products than I had expected. From our "Online Trend-setters" who are big brand buyers and prioritise the aesthetics of a product through to our "Quality Seekers" who explore new products to get the best texture or superlative flavour. Our "Affluent Explorers" are looking to be stimulated across their senses by new and exotic experiences versus our "Sensory Experimenters" who are looking to try new things. However, this latter group are more restrained thanks to their budget and appreciation of how what they buy, impacts the world around them.

This is just a small part of this piece of work. It also explores brands through this same sensory lens, it picks apart what drives behaviour for each segment and uncovers what prompts them to try something new. We look forward to sharing more with you over the coming weeks. If you'd like to hear more about this work, we'd be happy to share more info and arrange a presentation of the full results. The current study ranges from food, laundry and personal care products.